COMPANY PROFILE

Australia’s reputation for rich natural resources is internationally recognised. And many Australian innovations, such as ultrasound scanning, the aviation black box, cochlear implants, WIFI, and even Google Maps, are used around the world.

Research and Development is a big part of our technology companies, which are always striving to bring innovative new products to market. And many of them are seeking strategic investors to accomplish this.

Litmus Equity Investment Pty Ltd is in the perfect position, with the right timing, to introduce investors to these cutting edge hi-tech companies.

We welcome you to connect with us to learn more.

What we do

We help you make equity investments into Australian technology companies with strong patent positions in:

- Bio-medicine and medical devices

- IT software systems and integration

- Environmental protection and clean energy

- New and advanced materials sectors

We facilitate large, cross-border mergers and acquisitions in industries such as agriculture, mining and renewable energy, and we can assist with your involvement in large real estate developments, utilising our unique, high end corporate consulting services.

Innovation to Sustainability

We’ll help you to achieve sustainable growth and development through technological innovation and productivity, leading to the sustainable growth and development of a company, an industry – and the nation.

Our benefits

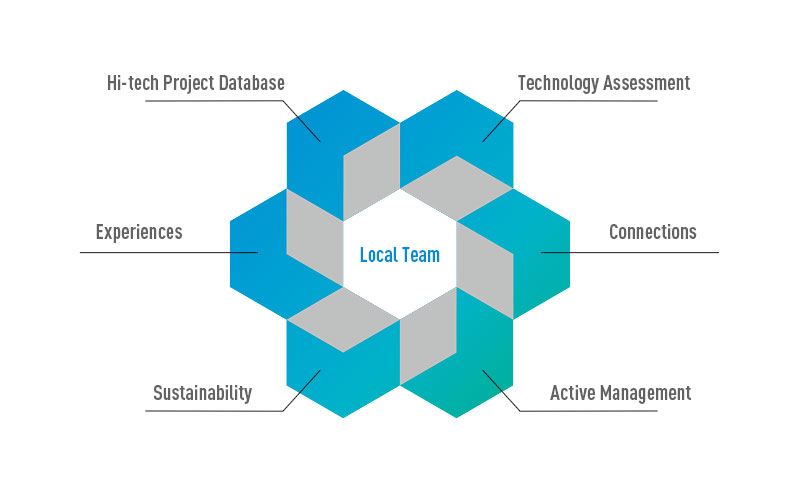

You gain access to many benefits when working Litmus Equity Investment:

- We’re a professional, reliable local team with a high-tech project database, active management, connections, and around 30 years of experience.

- We source, assess, and manage investment projects.

- Our relationship with the Australian Department of Industry, Innovation and Science, a number of research centres and patent management companies means we have access to many hi-tech projects

- We’re among a few investment management companies in the world that is able to actively manage hi-tech companies, by embedding Senior Project Managers and Sales Directors who bring profits to fruition.

OUR ADVANTAGE

- Professional and reliable local team: we rely on our Australian local team in various industries to source, assess and manage investment projects.

- A rich hi-tech project database: We can source many hi-tech projects which have Intellectual Property based on our relationship with the Australian Department of Industry, Innovation, and Science, a number of research centers, and patent management companies.

- Experience: the average working experience of the team is 30 years.

- Active management: There are many causes of failure to turning innovations into profitable businesses. We are among a few investment management companies in the world being able to ACTIVELY manage hi-tech companies, instead of making passive investment. Compared to traditional investors who would take a non-executive director and being updated about the company’s progress each quarter, we will embed Senior project managers will be embedded Sales Directors to investees to be in charge of the sales and profitability of the project companies. Innovation should also be market / sales – oriented.

Our Team

Peter Beaumont

Director Peter is a highly experienced and respected Senior Executive and Director with a 30 year history in Corporate Finance and Merchant Banking. Peter has been involved in Venture Capital through establishing the listed VC group SME Growth Limited and raising A$28 million in capital via the Australian Stock Exchange. He was a Director on the Investment Committee responsible for approving the direct investment of capital in Investees; as Head of the Investment Review Committee Peter reviewed the performance of each of the 14 investments on a quarterly basis. All the businesses have progressed including:

- Clover Corporation Limited –listed on the ASX it has a market capitalisation of $94M.

- AJ Lucas Group Limited (AJL) –ASX 2013 Market capitalisation AUD$183M.

- SP Telecoms Limited – TPG Telecom Limited 2013 market capitalisation $6.36 billion

- Tecra Limited – today, it is a subsidiary of 3M Corporation of the US with a turnover of USD$15 billion.

Peter has been involved in listing and acquisitions on the ASX including successfully representing Viterra Inc as Chairman of the Australian acquirer, in its A$1.6 billion public takeover of ABB Grain.

Peter has extensive experience as an investment director, in management and consultancy ranging from large corporations and financial institutions to small or family run businesses.

Helen Li

Director Peter is a highly experienced and respected Senior Executive and Director with a 30 year history in Corporate Finance and Merchant Banking. Peter has been involved in Venture Capital through establishing the listed VC group SME Growth Limited and raising A$28 million in capital via the Australian Stock Exchange. He was a Director on the Investment Committee responsible for approving the direct investment of capital in Investees; as Head of the Investment Review Committee Peter reviewed the performance of each of the 14 investments on a quarterly basis. All the businesses have progressed including:

- Clover Corporation Limited –listed on the ASX it has a market capitalisation of $94M.

- AJ Lucas Group Limited (AJL) –ASX 2013 Market capitalisation AUD$183M.

- SP Telecoms Limited – TPG Telecom Limited 2013 market capitalisation $6.36 billion

- Tecra Limited – today, it is a subsidiary of 3M Corporation of the US with a turnover of USD$15 billion.

Peter has been involved in listing and acquisitions on the ASX including successfully representing Viterra Inc as Chairman of the Australian acquirer, in its A$1.6 billion public takeover of ABB Grain.

Peter has extensive experience as an investment director, in management and consultancy ranging from large corporations and financial institutions to small or family run businesses.

Lisa Goodhand

Director Peter is a highly experienced and respected Senior Executive and Director with a 30 year history in Corporate Finance and Merchant Banking. Peter has been involved in Venture Capital through establishing the listed VC group SME Growth Limited and raising A$28 million in capital via the Australian Stock Exchange. He was a Director on the Investment Committee responsible for approving the direct investment of capital in Investees; as Head of the Investment Review Committee Peter reviewed the performance of each of the 14 investments on a quarterly basis. All the businesses have progressed including:

- Clover Corporation Limited –listed on the ASX it has a market capitalisation of $94M.

- AJ Lucas Group Limited (AJL) –ASX 2013 Market capitalisation AUD$183M.

- SP Telecoms Limited – TPG Telecom Limited 2013 market capitalisation $6.36 billion

- Tecra Limited – today, it is a subsidiary of 3M Corporation of the US with a turnover of USD$15 billion.

Peter has been involved in listing and acquisitions on the ASX including successfully representing Viterra Inc as Chairman of the Australian acquirer, in its A$1.6 billion public takeover of ABB Grain.

Peter has extensive experience as an investment director, in management and consultancy ranging from large corporations and financial institutions to small or family run businesses.

INNOVATION PROJECT

Canada Bay

AgedCare

primarily Adelaide metro located in Churchill, Christie’s Beach, Klemzig, Gilles Plains, and Hahndorf.

Deposits of $40mill, the actual cash settlement is $75mill.

This investment will return a 10% cash benefit to investors per annum.

Biosceptre

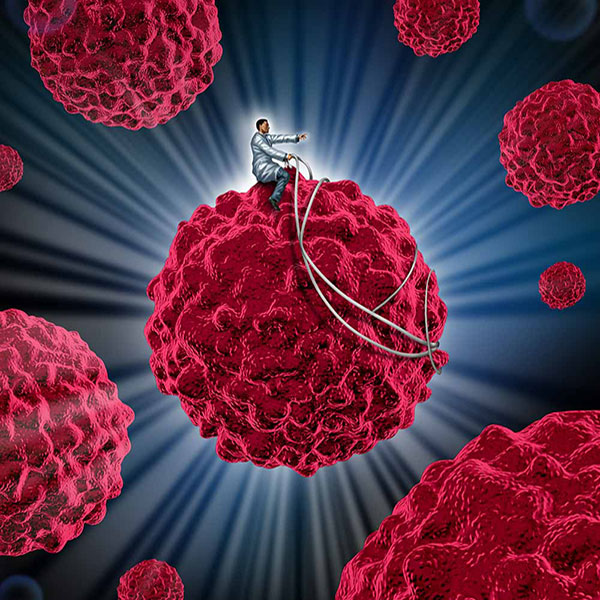

Biosceptre is a Cambridge University UK-based clinical-stage immuno–oncology company that has identified a novel and valuable cancer target marker (nfP2X7) that only appears on the cell surface of a wide range of cancers including Lung, Breast, Colorectal, and Prostate, but is absent in healthy tissue.

Biosceptre has developed a CAR-T immunotherapy targeting the nfP2X7 marker. CAR-T therapy is a form of immunotherapy that uses specially altered T cells to fight cancer. With CAR-T, white blood cells are removed and “trained" to recognise and kill cancer cells bearing the nfP2X 7 target.

Biosceptre has successfully closed its latest £7million 2021 raise and is seeking a PreIPO raise of £200 million (USD$272 mill) and continues to achieve increasing T-cell killing capacity utilising their technology. As a result of the latest test data results the current valuation for Biosceptre pre-IPO has risen to £302million

(USD$401 million).

The Directors are intending to undertake the IPO on the Nasdaq towards the end of 2024. In discussions with New York based broking houses, the company will be offering the IPO at a valuation of between USD$2.5billion to USD$3.5Billion.

Minomic

The Company is funding to (a) retire the Australian Govt substantial equity position in the company at market competitive pricing (it has been in place for 10 years), and (b) to raise further working funds to pursue the commercialisation of MiCheck ® in key markets (China/USA) and will allow finalisation of manufacturing as well as the rollout of the test via centralised laboratories.

Minomic is an immuno-oncology company founded in Sydney in 2007, which has developed a definitive diagnostic blood test for the early detection of prostate cancer – the MiCheck ® test. Clinical Studies have demonstrated significantly improved performance over existing prostate cancer testing with a 95% Sensitivity Result.

Lodestone Equities

Northside Private Hospital

This hospital comprises 14 operating theatres, 238 beds, and 391 car parking spaces, plus pathology, nuclear medicine, and radiology.

Partners